What is payroll accounting? Payroll journal entry guide

For example, if you hire a 1 what is a contra asset account the balance of contra asset worker to paint your office building, then it is likely that they will start working right away. On the other hand, if you hire an assistant accountant, then chances are that they won’t be able to work for another few weeks. Follow the basic steps to set up and run your first payroll. You’ll use these to calculate withholdings for each employee.

How To Calculate Your Payroll Liability

Dedicated software is the best way to avoid mistakes when working with tricky financial obligations. That’s why Joist syncs with QuickBooks for easy recordkeeping. Make sure they include dates so you know when you incurred your liabilities and when they’re due. To avoid missing your deadlines for paying liabilities, you need to keep track of them. There are a few things you can do to stay on top of them.

Types of payroll liabilities

Always check with the IRS to make sure you’re following the right steps. But recording payroll liabilities gets more complicated as you grow, hire new people, and offer more benefits. However, if you have only salaried employees, your payroll expenses will be more predictable. Money paid to employees as part of a PTO plan also counts as a payroll liability. Employees often contribute to retirement and subsidized health insurance plans by using a portion of their pre-tax earnings. As an employer, you’re responsible for holding onto and passing along those payments.

That means you use the service for the month and pay at the end of the month or what is budgeting planning and forecasting bpandf the following month. As your business grows, you may offer benefit plans to motivate employees. Workers can choose to voluntarily withhold payroll dollars to fund benefit plans. You pay unemployment taxes, both federal and state (if applicable), separately from the taxes shown in Journal 2 and Journal 3.

Nobody likes to be paid late

- Every seasoned business owner knows that payroll isn’t just about cutting checks.

- Journal 1 shows the employee’s gross wages ($1,200 for the week).

- Employee compensation, taxes, and voluntary deductions all generate payroll liabilities.

- The dedicated software programs that manage payroll automatically keep track of all the relevant information in one place.

- But if you don’t take these liabilities into account when creating your budget, you could run out of funds.

Familiarize yourself with any local tax laws that could require additional payroll deductions. Imagine you own a handyman services company with an employee named Alice. But it’s key to understanding your company’s financial health. By tracking your payroll liabilities and expenses separately, you get a clearer picture of your cash flow. This ensures you have enough money to meet all your obligations. Payroll liabilities are amounts you owe but haven’t paid yet.

Some of the most common payroll liabilities are unpaid wages. But other examples include taxes, deductions, and paid time off (PTO). Depending on when a company processes payroll and the pay date, it’s usually only a matter of days or weeks before payments are due.

Read on to learn all you should know as a business owner. An employer may have both liabilities and expenses for the same employee, due to paid time off. For example, say an employee has 24 hours of PTO and has already taken eight hours off. Those eight hours have already been paid out and are an expense.

Taxes and other deductions are based on the forms your employees fill out. The forms will tell you how much of an employee’s wages you should what is notes payable definition how to record and examples deduct each pay period. Calculations will also depend on your state and sometimes your city or county.

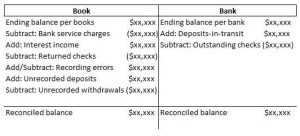

While the cash is technically in your hands, it’s a liability. Until your payroll software remits payroll taxes to the appropriate tax authorities, they’re liabilities for your business. You can use payroll software to reconcile the payroll liability data and ensure you’re processing payroll correctly.

In these initial entries, you also record any employment taxes you owe. You’ll record the $150 and $76.50 as payroll liabilities, along with your company’s matching contribution of $76.50 for FICA taxes. You then pay Alice her net wages and send the withheld amounts to the appropriate agencies, along with your company’s share. These represent money you owe to different groups, such as your employees, the government, and insurance providers. Understanding and managing these liabilities is crucial for maintaining financial stability. When it comes to handling your federal payroll tax liabilities, deposit them according to your IRS depositing schedule.